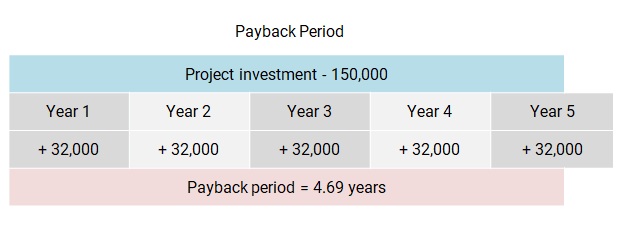

The discount rate represents the opportunity cost of investing your money. Essentially, you can determine how long you’re going to need until your original investment amount is equal to other cash flows. We will also cover the formula to calculate it and some of the biggest advantages and disadvantages. The other project would have a payback period of 4.25 years but would generate higher returns on investment than the first project. However, based solely on the payback period, the firm would select the first project over this alternative.

Payback Period: Definition, Formula, and Calculation

On the other hand, Jim could purchase the sand blaster and save $100 a week from without having to outsource his sand blasting. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

The Time Value of Money (or Net Present value)

The simple payback period formula is calculated by dividing the cost of the project or investment by its annual cash inflows. The project has an initial investment of $1,000 and will generate annual cash flows of $100 for the next 10 years. Discounted payback period refers to time needed to recoup your original investment. In other words, it’s the amount of time it would take for your cumulative cash flows to equal your initial investment.

Discounted Payback Period

Profitability is a key indicator of financial health and affects an organization’s ability to reinvest in growth, distribute dividends, or pay down debt. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets, managed by professionals. Let us understand the concept of how to calculate payback period with the help of some suitable examples.

- As such, it should not be used alone as an investment appraisal technique – other methods should be used such as ROI, NPV or IRR.

- However, a shorter period will be more acceptable since the cost of the investment can be recovered within a short time.

- Obviously, the longer it takes an investment to recoup its original cost, the more risky the investment.

- This is a particularly good rule to follow when a company is deciding between one or more projects or investments.

In studying “Investment Decisions” for the CMA, you should learn to evaluate various types of investments by analyzing cash flows, risks, and returns to make sound financial decisions. Understand capital budgeting techniques, including net present value (NPV), internal rate of return (IRR), and payback period, and how to apply them to assess project viability. Analyze the impact of investment decisions on a company’s financial health and strategic goals. Evaluate the role of cost of capital in decision-making and explore the trade-offs between risk and return.

Discounted Payback Period Formula

It can be used by homeowners and businesses to calculate the return on energy-efficient technologies such as solar panels and insulation, including maintenance and upgrades. It represents the rate of return at which the project breaks even, helping to gauge its potential profitability. NPV measures the difference between the present value of cash inflows and the present value of cash outflows over a project’s lifetime.

It is considered to be more economically efficient and its sustainability is considered to be more. Management will set an acceptable payback period for individual investments based on whether the management is risk averse or risk taking. This target may be different for different projects because higher risk corresponds with higher return thus longer payback period being acceptable for profitable projects. For lower return projects, management will only accept the project if the risk is low which means payback period must be short. This method provides a more realistic payback period by considering the diminished value of future cash flows.

Additionally, gain proficiency in performing sensitivity analyses to assess how changes in assumptions affect investment outcomes, preparing you to make informed, data-driven decisions. Discounted payback period will usually be greater than regular payback period. Investments with higher cash flows toward the end of their lives will have greater discounting. Forecasted future cash flows are discounted backward in time to determine a present value estimate, which is evaluated to conclude whether an investment is worthwhile. In DCF analysis, the weighted average cost of capital (WACC) is the discount rate used to compute the present value of future cash flows. WACC is the calculation of a firm’s cost of capital, where each category of capital, such as equity or bonds, is proportionately weighted.

The appropriate timeframe for an investment will vary depending on the type of project or investment and the expectations of those undertaking it. For example, if solar panels cost $5,000 to install and the savings are $100 each month, it would take 4.2 years times interest earned ratio calculator pricing strategy consultant to reach the payback period. As you can see, the required rate of return is lower for the second project. If you have a cumulative cash flow balance, you made a good investment. Thus, you should compare your year-end cash flow after making an investment.

The payback period for this project is 3.375 years which is longer than the maximum desired payback period of the management (3 years). The situation gets a bit more complicated if you’d like to consider the time value of money formula (see time value of money calculator). After all, your $100,000 will not be worth the same after ten years; in fact, it will be worth a lot less. Every year, your money will depreciate by a certain percentage, called the discount rate. So, if an investment of $200 has an annual return of $100, the ROI will be 50%, whereas the payback period will be 2 years ($200/$100).

Comentários