Establishing a clear petty cash policy helps set the purpose and use of the petty cash fund, and lists allowable expenses. The Galaxy’s Best Yogurt establishes a petty cash fund on July 1 by cashing a check for $75 from its checking account and placing cash in the petty cash box. At this point, the petty cash box has $75 to be used for small expenses with the authorization of the responsible manager. The custodian should prepare a voucher for each disbursement and staple any source documents (invoices, receipts, etc.) for expenditures to the petty cash voucher. At all times, the employee responsible for petty cash is accountable for having cash and petty cash vouchers equal to the total amount of the fund.

Cash overage in replenishment of petty cash

However, the availability of petty cash doesn’t mean that it can be accessed for any purpose by any person. Often, a few individuals are authorized to approve disbursements and can only do so for expenses related to legitimate company activities or operations. A petty cash fund will undergo periodic reconciliations, with transactions also recorded on the financial statements. the petty cash account cash short and over is a permanent account. In larger corporations, each department might have its own petty cash fund. As a company grows, it may find a need to increase the base size of its petty cash fund. The entry to increase the fund would be identical to the first entry illustrated; that is, the amount added to the base amount of the fund would be debited to Petty Cash and credited to Cash.

- This term pertains primarily to cash-intensive businesses in the retail and banking sectors, as well as those that need to handle petty cash.

- Finance Strategists has an advertising relationship with some of the companies included on this website.

- Alternatively, if there had been too much cash in the petty cash box (a rare condition indeed!), the entry would be reversed, with a debit to cash and a credit to the cash over and short account.

- As an example of how the cash over and short account operates, a controller conducts a monthly review of a petty cash box that should contain a standard cash balance of $200.

- With its advanced reporting capabilities, QuickBooks makes it simpler to monitor and reconcile petty cash expenses across the organization.

Petty cash funds

A sample presentation of the Other Expenses line item in an income statement appears in the following exhibit. Petty cash is the money that a business or company keeps on hand to make small payments, purchases, and reimbursements. Either routine or unexpected, these are transactions for which writing a check or using a credit card is impractical or inconvenient. Ideally, people in this role will be comfortable handling business expenses and have experience with financial statements. Those with prior financial accounting experience are especially great with this, but anyone that’s handled expense accounts should be fine. Transitioning to digital solutions for petty cash management has numerous benefits, such as increased efficiency, improved tracking, and reduced manual entry errors.

The cash over and short account

As a result, businesses can focus on optimizing their operations and achieving growth. In today’s digital era, many businesses are seeking accounting software solutions to revolutionize their petty cash management systems. Such software not only simplifies bookkeeping but also reduces the risk of human errors. The logical first step is to document the reimbursement, for example by writing out a receipt.

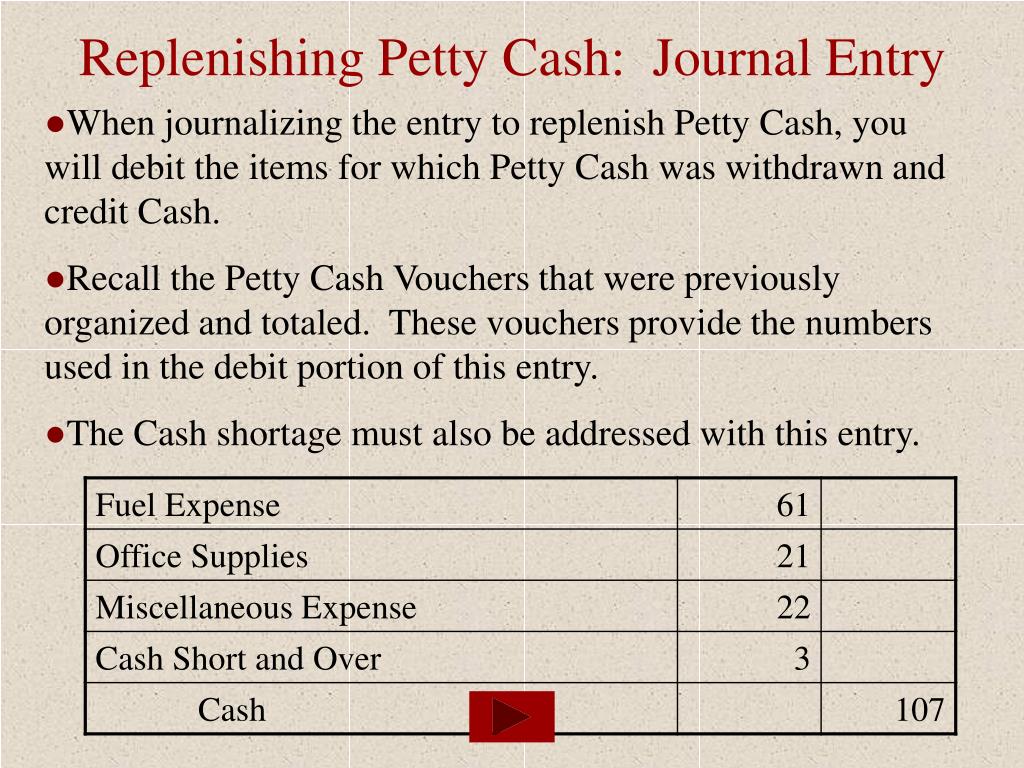

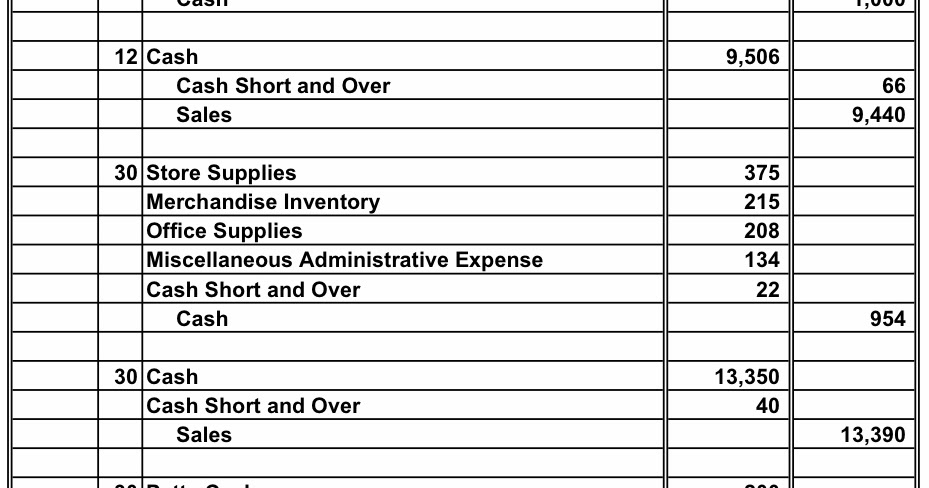

There is no journal entry at this point; instead, the cash balance in the petty cash fund continues to decline, while the number of receipts continues to increase. The total of the receipts and remaining cash should equal the initial amount of petty cash funding at all times. However, recordation errors and theft may result in a variance from the initial funding amount. When the company has the cash overage in the petty cash fund, it can make the journal entry by debiting the expenses account and crediting the cash over and short account together with the cash account. In this case, we can make the journal entry for cash shortage by debiting the cash account and the cash over and short account and crediting the sales revenue account.

Replenishing Petty Cash

The English word “petty” derives from the French petit, which means “small” or “little.” Likewise, “petty” means minor or insignificant. So petty cash refers to a small sum of money set aside for trifling or little purchases, as opposed to major expenses or bills. Commercial transactions are increasingly cashless—even at small retailers and restaurants, where purchases traditionally have relied heavily on coins. By having a petty cash cashier and a petty cash custodian, the dual-process helps to keep the funds secure and ensure that only those authorized have access to it. With clear policies, diligent record-keeping, and regular reviews, your petty cash fund can truly become your small business’s secret weapon for financial agility.

The account stores the amount by which the actual ending cash balance differs from the beginning book balance of cash on hand, plus or minus any recorded cash transactions during the period. If there’s a shortage or overage, a journal line entry is recorded to an over/short account. The over or short account is used to force-balance the fund upon reconciliation. A petty cash fund is a small amount of company cash, often kept on hand (e.g., in a locked drawer or box), to pay for minor or incidental expenses, such as office supplies or employee reimbursements.

Some organizations use a separate cash register for the petty cash, and others just track the transactions on ordinary receipts or invoices. In any given month, a custodian will make various disbursements from the petty cash fund. Because a petty cash voucher is made out for all disbursements, the total of the vouchers and the remaining cash should always equal the amount of the fund (in this case, $100). The primary use of the cash over and short account is in cash-intensive retail or banking environments, as well as for the handling of petty cash. In these cases, cash variances should be stored in a single, easily-accessible account. This information is then used to track down why cash levels vary from expectations, and to eliminate these situations through the use of better procedures, controls, and employee training.

Comentários